Agritech funding in LMICs: How did it go in 1Q24? #55

As April comes to an end, it is time to look back at the first quarter of this year. Throughout the year ArisTechia tracks data on agritech funding by startups that provide digital solutions for smallholder agriculture across low-and middle income countries (LMICs). We focus on four regions: Africa, South Asia and Southeast Asia. In this article, I look at how the sector has performed on a quarterly basis, comparing 1Q24 VS 1Q23.

The headline is that it has been a stronger first quarter than it was a year ago, with a greater number of deals and greater overall funding going toward agritechs. At a first glance, it looks like 2024 could be a better year than 2023. Below, I unpack the data and highlight the main trends that I am seeing.

A look at the numbers: How does 1Q24 compare VS 1Q23?

In 1Q24, we tracked 34 deals by agritech startups working on smallholder agriculture across the three regions. This compares to 24 reported deals for the same period a year ago, representing 42% growth in overall activity year-on-year.

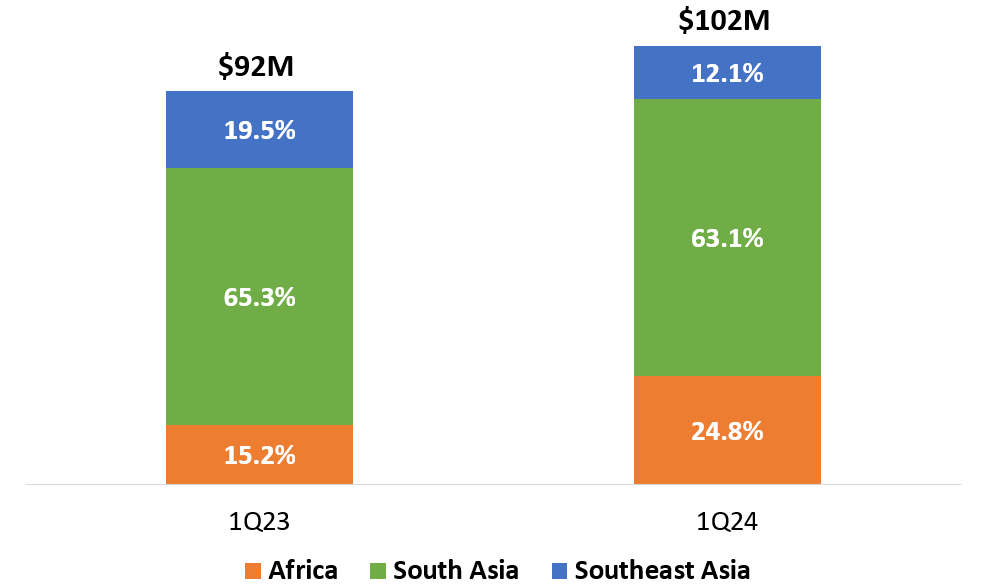

The larger number of deals resulted in a larger amount of funding going to agritechs in 1Q24 in the three regions, when compared to 1Q23. The total amount of reported raises for the quarter just ended is ∼$102 million. This compares to ∼$92 million for the same period a year ago. Funding going to the sector therefore expanded by 12% year-on-year.

Fig. 1: Agritech funding in LMICs, 1Q23 VS 1Q24

Source: ArisTechia

While we saw greater activity in 1Q24 VS 1Q23, the average deal size was lower this last quarter. We are looking at ∼$3.0 million in the first quarter of 2024 as opposed to ∼$3.8 million in the same period last year.

This is explained by the relative impact of the largest raises within the quarters. In 1Q23, the four largest raises of +$10 million amounted to 70.2 million and represented 77% of the total amount of funding in the quarter. Three out of these four were from India, with the exception (fourth place) of the $13.5 million Pre-Series B of EdenFarm in Indonesia. These were important deals, such as the $13.7 million Series D by CropIn. Together with eFishery’s $108 million mega Series D in Indonesia in May 2023, CropIn’s raise was the only Series D round in the agritech sector tracked ArisTechia since it started publishing in February 2022.

In contrast, there were only two +$10 million raises in 1Q24, amounting to $32.5 million and making for just 36 percent of the amount of funding in the quarter (see fig. 2). But 1Q24 witnessed a more solid performance across the board. If we look at the list of top reported deals over $500,000, in 1Q24 we have to get to the 14th place in that list to go below the threshold of $2 million. In 1Q23, there were only five deals above this threshold.

Fig. 2: Top reported agritech deals over $500K, 1Q23 VS 1Q24

Source: ArisTechia

The table above shows quite clearly the dynamism in 1Q24, especially at Seed to Series A stages (Seed/Pre-Series A/Series A). The quarter saw a total of $61.9 million funding across these three stages, while the same figure for 1Q23 was $23.7 million.

How did the regions do?

Most of the activity was in South Asia (India), and that of course applies this year as much as last year. If we just look at the largest deals by Indian agritechs in the table above, we will see that they made for ∼59% of the total amount of funding going to the sector, globally, in 1Q24. The same figure in 1Q23 was ∼65%. This trend can be explained by the growing importance of other markets and regions within the agritech landscape in LMICs. This is happening in a global context where the overall trajectory is that of a (moderate) growth.

We can look at Africa, for example. In this last quarter two Africa-focused agritechs, Hatch Africa and Apollo, took the second and the third spots in the table of the largest agritech deals. This is quite significant. Hatch, which operates in the poultry sector, raised $9.5 million to scale up in Kenya, Ghana, and Cote d’Ivoire. Apollo received a $10 million investment to grow its product and financing platform for smallholders. With this raise, Apollo reached $67.8 million cumulative funding since it started operations in 2016.

Africa takes a larger share of global agritech funding than it did a year ago. It has grown from 15% in 1Q23 to 25% in 1Q24, reaching $25.3 million. But one must not forget that 95% of the total funding for the region for the last quarter comes from just three deals. We get to this percentage by adding to the above mentioned deals by Hatch and Apollo the $3.7 million Pre-Series A by Shamba Pride in Kenya, which occupies position 12th in our table above. While there is some good traction, a lot of the activity is around grants, smaller tickets and at Pre-Seed and Seed stage.

Fig. 3: Agritech funding by region, 1Q23 VS 1Q24

Source: ArisTechia

Southeast Asia’s contribution, on the other hand, has declined from 20% in 1Q23 to 12% in 1Q24, with South Asia taking the lion’s share at 63%. Southeast Asia witnessed the same level of activity in 1Q24 as in 1Q23, but the main difference was the absence of a large +$10 million deals in the leading market of Indonesia, such as the Pre-Series-B raise by EdenFarm in February 2023. Still, during the last quarter, Indonesian startup Semaai secured $4.7 million Pre-Series A to scale up its digital solution centered around a marketplace app for inputs. This followed the $1.65 million that Semaai had raised just in February 2023.

A positive trajectory for Africa

In my view, a key takeaway from these numbers is the relative growing importance of Africa within the global landscape. I think this argument is supported by two other developments in recent months.

First, as we have just entered the second quarter of 2024, long-established African agritechs like SunCulture and Pula have announced substantial raises. It was just at the beginning of this month that SunCulture completed an oversubscribed $27.5 million Series B fundraise to scale its solar IoT-enabled irrigation systems across sub-Saharan Africa. Less than two weeks later, Kenya-based agri insurtech Pula announced its $20 million Series B. This is a promising start of the year. We shall see more of these larger raises in the coming months. I suspect Nigeria, which is has been remarkably quiet in recent months, might be a likely candidate to attract new funding.

Another promising development for the region is the growing interest of well-established Indian agritechs in venturing into Africa. I take this as a sign of growing maturity in a few key markets.

In January, Ninjacart, one of the country’s main B2B agri e-commerce platforms, was the latest Indian agritech to announce plans to venture into Africa. It formed partnership a with a local organisation to start working in Egypt. The same month, another major Indian player like Arya.ag partnered with Ethiopian agritech Lersha to initiate digital agriculture initiatives in East Africa. These moves followed previous announcements by WayCool, another leading marketplace in India, which unveiled plans to enter Kenya via its local arm CENSA, and by StarAgri, a company backed by investors such as Temasek and Investcorp, which was reported to have launched a global expansion plan starting from Tanzania, Uganda, and Nigeria.

All of these organisations work with Farmer Producer Organisations (FPOs) in India and seem confident on the potential to export their B2B2C models for market linkages and agri value chain digitalisation to Africa. I look forward to seeing how this kind of South-to-South partnerships will shape up in coming months.

I hope you found this analysis piece insightful, and if you do so I am grateful if you could share this through your network. Next week ArisTechia will be back with the news roundup. As usual, thoughts and feedback are welcome.