Digital Agriculture in LMICs -13 Jun #60

Thrive Agric partners with Visa for Kenya expansion; Pakistan’s Bank Alfalah launches Agri DFS; Singaporean startup AgriG8 raises funding

10/06/24

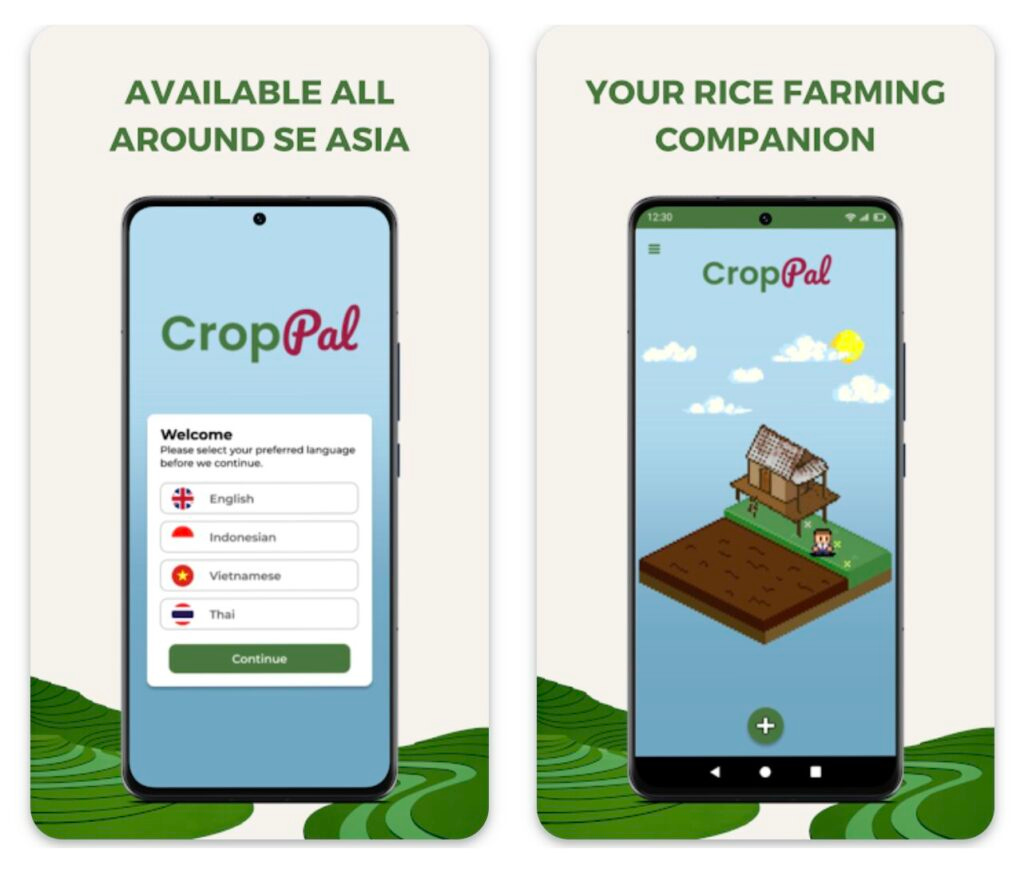

Southeast Asian agri/fintech AgriG8 bags funding to decarbonise rice farming

Singapore-based agri/fintech AgriG8 has raised an undisclosed amount funding from Better Bite Ventures and The Trendlines Group, which has backed the startup from its inception. AgriG8 works with smallholder farmers in the rice value chain across Southeast Asia. It will use the investment to develop and grow its CropPal digital platform. CropPal is a gamified solution that helps farmers decarbonising their production methods. Through the platform, organisations working with rice farmers, such as NGOs and cooperatives, can finance and incentivise methane-cutting agricultural practices. On the CropPal app, farmers input data related to a variety of agricultural practices, for example their seeding approach, water management and nutrient management, and receive rewards such as loan rebates. Besides the farmer facing app, AgriG8 has a dashboard for lenders and farm managers enabled by analytics and machine learning (ML). Founded in 2021, AgriG8 has completed a pilot in central Thailand, with more trials to be held in Vietnam and Cambodia.

Photo credit: AgriG8

10/06/24

Pakistan’s Bank Alfalah launches digital agri financing product

Pakistan’s bank Bank Alfalah has launched a digital agriculture financing product for smallholder farmers. The product allows farmers to obtain financing for buying livestock and agricultural inputs (equipment). Farmers can access financing at a subsidised rate of 2 percent, enabling them to establish sustainable income streams. The bank said that the product has been made available to farmers of different income levels and in different agricultural regions, including flood-affected areas in the state of Sindh. According to the bank, to date USD 359,000 have been disbursed to farmers. Currently women account for 24 percent of the total customer base. In March last year, Bank Alfalah partner with local agritech SAWiE, a provider of climate smart advisory, to provide digital agriculture solutions to the bank’s farmer customers, with a view to facilitate access to markets and finance.

11/06/24

Thrive Agric and Visa partner for Kenya expansion

Nigerian agritech Thrive Agric has partnered with payment company Visa to expand its operations in Kenya. Founded in 2017, Thrive Agric has an end-to-end solution that digitises the agricultural value chain, from input financing to agri advisory and market access. In December 2022, the agritech won the USD 100,000 grand prize of the Visa Everywhere Initiative 2022. Through the partnership with Visa, Thrive Agric will establish local hubs in five counties of Kenya (Busia, Homabay, Migori, Nandi, and Narok). The hubs will serve as aggregation points for produce during harvest, supporting up to 10,000 farmers. The two hubs of Busia and Homabay will serve also as learning centres providing farmer training and access to agricultural inputs. The partnership with Visa will facilitate access to digital financial services, including the opening of bank accounts and the issuance of Visa cards. Thrive Agric started in Nigeria and it has over time expanded to neighbouring Ghana. The agritech states that it has so far reached 800,000 farmers.

Photo credit: Thrive Agric

11/06/24

Nigerian agritech Winich Farm reaches 80,000 users

Nigeria’s agritech Winich Farms has released new information about its market reach. Established in 2020, the startup’s core offer is a market linkages platform connecting smallholder farmers with buyers such as factories and retail businesses. Over time, Winich has expanded to support embedded finance and traceability in agricultural value chains. At the recent GITEX Africa event, the company said that its platform has reached over 80,000 users. This figure includes smallholder farmers, agents, truck drivers, and buyers. The platform is operational in 25 states in Nigeria and has facilitated the trading of USD 30 million worth of agricultural produce in 2023. In Nigeria, there are approximately 38 million smallholder farmers, representing 20% of the population and responsible for producing 90% of the country’s food supply. It is estimated that 72% of Nigerian farmers live below the poverty line. According to PitchBook, Winich Farm has to date raised USD 840,000. The startup is part of the GSMA AgriTech Accelerator funded by the German Development Agency (GIZ).

11/06/24

FAO announces open source tool for EUDR

FAO has published information and technical specifications of a new open-source tool that supports agribusinesses and farmers to comply with recently introduced EU Deforestation Regulation (EUDR). This regulation stipulates that businesses that sell products in EU markets must be deforestation-free. The tool named “What is in that plot” (Whisp) supports due diligence process for EUDR requirements. It combines and analyses data from different sources, primarily remote sensing data from satellites, to gather information about land use within a specific plot.

Whisp is the output of FAO’s collaborative effort with the European Union’s Team Europe Initiative (TEI), FAO’s Accelerating Innovative Monitoring for Forests programme (AIM4Forests) and the Forest Data Partnership (FDaP) working with the AgStack Foundation. Organisations who want to produce land cover information to enable farmers to access regulated EUDR markets can access the Whisp tool as an operational application programming interface (API). Whisp is also available on Earthmap for demonstration and visualisation purposes. In addition, Whisp can be added to geolocation mobile applications such as the Ground app, enabling farmers to generate their own data on their mobile devices.