Digital agriculture in LMICs - 27 Feb #80

India surpasses 20M digital farmer IDs; Wami Agro secures funding from Acumen; eFishery to face heavy financial losses

24/02/25

Ghana’s Wami Agro raises funding from Acumen

Ghanaian agritech Wami Agro has received new funding (undisclosed) from nonprofit impact investment fund Acumen. The agritech has a bundled package of tech-enabled solutions, including market linkages for outputs, digital financial services, such as credit scoring for Village Savings and Loan Associations (VSLAs), and agri advisory on climate-resilient farming practices. The agritech plans to utilise the investment to scale operations, expand sourcing to Sierra Leone and Burkina Faso, and roll out its landing platform and farm management platform Pukpara.

Since its inception in 2019, Wami Agro has built a network across six regions of Ghana of +14,000 smallholder farmers (55% of whom are women) in value chains such as rice, maize, soya, and sorghum. The company also collaborates with approximately 50 aggregators and producers and sells directly over 5,000 tons of grains. Wami Agro aims to reach 100,000 farmers by 2027.

24/02/25

India surpasses 20M digital farmer IDs as part of agri DPI efforts

New data has emerged from India’s Ministry of State for Agriculture & Farmers’ Welfare on the progress of creating digital farmer IDs as part of the country’s AgriStack (Kisan ki Pehchaan). At the start of February, 20 million digital farmer IDs have been created. AgriStack is a farmer-centric, open-source Digital Public Infrastructure (DPI). The government aims to generate 110 million IDs by 2026-27.

Phot credit: Timesbull.com

The farmer IDs include demographic details, as well as information on land holdings and crops sown, enabling farmers to digitally identify and authenticate as they access government schemes including credit, insurance and market linkages. AgriStack also enables agritech innovations as it provides a robust digital infrastructure that makes accessible a vast amount of data. AgriStack is one of the two key initiatives under the government’s umbrella scheme dubbed ‘Digital Agriculture Mission’ (DAM).

25/02/25

Investors to bear heavy financial losses in eFishery fraud scandal

According to reports, investors backing Indonesia aquatech eFishery are likely to get back less than 10 cents for every dollar they invested in the company. Investors, including SoftBank and Temasek, collectively supported the company with approximately USD 315 million. Founded in 2013, eFishery became the first agritech unicorn in Indonesia and the only aquatech unicorn globally. The company’s management are accused of inflating revenue figures by almost USD 600 million (75 per cent of the reported figures) in the nine months through to September 2024. They are also suspected to have manipulated the number of fish feeders that the company operates, with real figures being at 25,000 as opposed to the reported 400,000.Investigators also found that there was a high default rate on the financial services that eFishery was providing to farmers, with the company bearing all losses when loans were not paid back.

The company’s CEO Gibran Huzaifah and Co-Founder Chrisna Aditya were suspended in December following an investigation into alleged irregularities. Since the scandal emerged, the company laid off more than 90 per cent of its workforce. In a recent interview with Tech in Asia, Mr Huzaifah denied allegations of inflating financials for personal gain and issued an apology to staff and farmers.

26/02/25

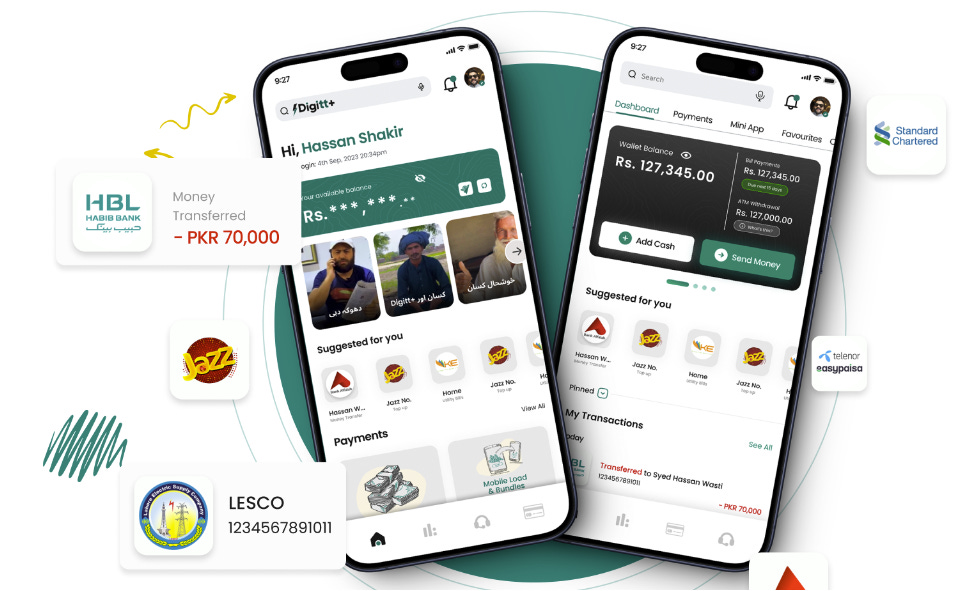

Concave Agri and Digitt+ partner for digital financial services in Pakistan

Pakistan’s agritech company Concave Agri has partnered with AgriFinTech Digitt+. Farmers can now make digital payments at select Concave Agri retail outlets through Digitt+, reducing the risks associated with cash handling. Additionally, Concave Agri’s premium seeds, fertilisers, and pesticides will be available through Digitt+’s digital marketplace, Agrimall, offering access to agricultural products at government-approved prices. This move towards digital transactions allows farmers to build a financial history, enabling access to credit and loans.

Photo credit: Digitt+

Licensed by the State Bank of Pakistan as an Electronic Money Institution (EMI), Digitt+ provides a financial services for farmers and rural communities supporting financial inclusion. According to its website, it has boarded 80,000+ users. Established in 2019, Concave Agri is owned by business conglomerate Lakson Group, which has operations in the agrifood sector. One of Concave Agri’s main services is the Kissan Madadgar app, a helpline that provides real-time farming advisory and support to farmers including weather alerts, pest and disease management advisory and market prices.

26/02/25

Zimbabwe to introduce digital farmer registry

Zimbabwe is set to launch a digital farmer ID registry, inspired by similar initiatives in India and Nigeria. The system is expected to initially deployed in the tobacco sector. It will collect biometric data from farmers to facilitate secure transactions and provide access to government support programmes. This digital ID programme is expected to enhance transparency in value chains, reduce fraud, and improve financial access for farmers (subsidies, loans, and insurance). It should also ensure efficient delivery of resources, boosting productivity for farmers.

The Zimbabwe initiative is part of the broader regional program known as the SADC Digital Farmer ID Initiative. The Southern African Development Community (SADC) is a regional organisation made of 16 member states in Southern Africa. While specific details about the initiative are still limited, ArisTechia understands that the digital ID registry is being developed in collaboration with the Centre for Coordination of Agricultural Research and Development for Southern Africa (CCARDESA).