Key Insights into 2024 Agritech Funding in LMICs - #76

Another year has ended, the numbers are in, and they confirm what many in the sector have felt: 2024 has been a particularly tough year for agritech funding.

In this special Friday edition, I leverage ArisTechia’s reporting on digital agriculture news across low- and middle-income countries (LMICs) to analyse agritech funding trends in our key focus regions – Africa, South Asia, and Southeast Asia.

The headline finding? Agritech startups in these three regions raised a total of $303 million in 2025 across 65 reported deals. This represents a steep 46% decline from the $564 million recorded in 2023. While the number of deals held steady compared to 2023 (62 deals), the funding totals fell far short of the previous year.

Disclaimer: ArisTechia focuses on upstream agritech innovations, including "on-farm" and post-farm digital solutions that directly impact farms or farmers. Our reporting does not cover consumer-end innovations in agricultural value chains (e.g. foodtech).

The big picture: 2024 VS 2023

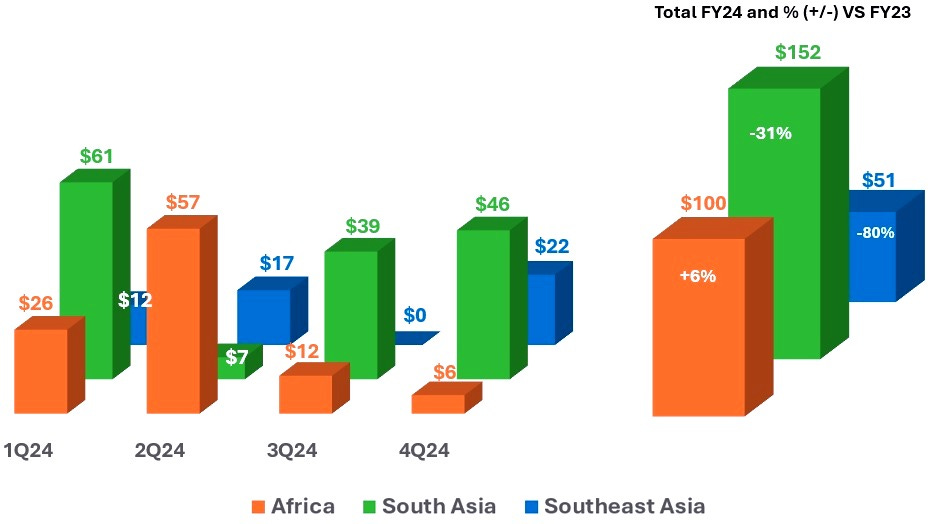

Here’s how agritech funding in LMICs compares quarter by quarter (figure 1). In 2023, after a slow start, funding surged in the third and fourth quarters, delivering a strong finish. In contrast, 2024 started off promisingly but quickly lost momentum, resulting in a relatively sluggish year overall.

Fig. 1: Agritech funding quarter by quarter, 2023 VS 2024

Source: ArisTechia

If we look at regional trends (figure 2), there’s some good news: Africa performed better in 2024 than in 2023, with a 6% increase in funding. This is great to see. The biggest decline was in Emerging APAC. South Asia experienced a 31% drop in funding, while Southeast Asia saw a dramatic 80% decline.

There is a significant “but.” Last year’s strong performance in APAC, particularly Southeast Asia, was largely driven by the massive $200M Series D raise of Indonesian aquatech eFishery. We didn’t see a comparable deal in 2024. Even setting that aside, the overall trend in 2024 remained less favourable compared to the previous year, with both the second and third quarters underperforming relative to the same periods in 2023.

Fig. 2: Agritech funding by region in 2024 ($M)

Source: ArisTechia

In 2024, ArisTechia reported a total of 65 deals across three regions, a slight increase from 62 in 2023. However, as shown in Figure 3 below, more than half of the deals occurred in the first quarter (33 deals). While the year was off to a very good start, eventually 2024 didn’t deliver to its initial promise. In 2024, activity declined as the months went by, and it was quite weak when compared to the previous year, especially in the second half.

Fig. 3: Number of agritech deals by region in 2024 VS 2023

Source: AristTechia

So what happened in 2024? Similar to 2023, investor confidence in digital solutions that enable market linkages for farmers remained strong. We tracked $127M in investment across 15 deals for startups focused on market linkage platforms for agri-inputs and outputs—representing approximately 42% of the total agritech funding for the year. This is comparable to 2023, when startups centered around market-linkage innovations secured $148M over 20 reported deals.

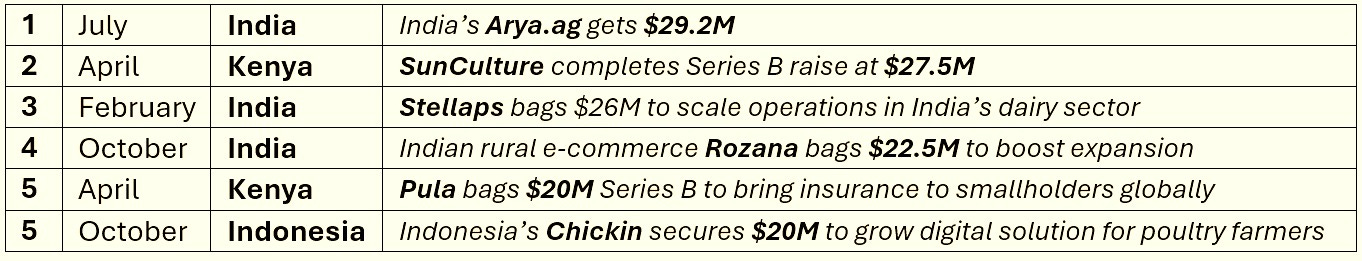

Other than market linkages, investors in 2024 increasingly turned their attention to startups offering innovative solutions to climate challenges. We tracked $53M across seven deals in climate-smart, nature-based solutions, and weather-related innovations. Additionally, agri digital financial services (DFS) providers attracted $26M, including a notable $20M Series B round for Insurtech Pula in Kenya in April.

In 2024, providers of market linkages, climate-driven solutions, and Agri DFS (Digital Financial Services) accounted for 68% of the total investment in digital agriculture startups addressing the needs of smallholder farmers. The majority of the remaining funds were directed toward established companies offering holistic solutions that address multiple use cases, including advisory services. What became clear – if further confirmation was needed – is that standalone digital advisory services, no matter how good they are, are less relevant and therefore less attractive for investment.

Fig. 4. Top deals (+$20M) reported by ArisTechia, 2024

A closer look at agritech markets

Africa

In Africa, Kenya had a strong year, consolidating its role as a regional hub and an agritech leader globally. We tracked more deals in 2024 (11) in the country than in 2023 (7), as funding grew 62% year-on-year to $63M. In 2023, Kenyan agritechs raised 51% of the funding in Africa (7% globally), and in 2024, this figure rose to 63% of regional funding—representing $2 for every $3 raised on the continent. That was a remarkable 21% of global agritech funding. The $27.5M Series B raise in April by Kenya-based SunCulture was not only the largest deal in Africa but also the second largest globally, after India’s Arya.ag $29.2M July raise.

The rest of Africa saw some good activity and increased diversification in 2024. Agritechs raised funds in seven countries, including Nigeria and Ghana, but also in Morocco, Senegal, Tanzania, Uganda, and Zambia. An interesting trend this year was the growing number of raises by agritechs operating across multiple regional markets, signaling a shift toward scalable, regional approaches. Notable examples include SunCulture, Pula, as well as players like Hatch Africa, eAgronom, and Insurtech IBISA. Estonia-based eAgronom, for example, secured in July $10.8M Series A to expand its regenerative agriculture solutions. Since 2022, it has been active in Rwanda, Kenya, South Africa, and Tanzania, with plans for further expansion in Uganda and Zambia.

India

India's agritech sector saw a significant decline in 2024 compared to 2023. As the largest agritech market in the LMICs, India tracked fewer deals (16, down from 22 in 2023) and less funding. Indian agritechs raised $150M, marking a 50% year-on-year decrease. Despite this, India still represented about 50% of the total agritech funding across LMICs (Africa and Emerging APAC).

The slowdown in venture capital, driven by inflation, market uncertainties, and inflated valuations from previous years, continued to impact early-stage ventures in 2024. Additionally, we did not witness the same high-value deals of 2023, such as the $62.5M raised by Leads Connect or the $46M raised by Vegrow. Arya.ag’s $29.2M raise in 2024 was the largest deal of the year across all regions covered by ArisTechia, bringing the agritech to an impressive market evaluation of $325M.

Southeast Asia

Southeast Asia's agritech landscape showed mixed results in 2024. Indonesia, which had a standout year in 2023 due to eFishery's $200M deal, faced a slowdown. Even excluding the eFishery deal, the country showed weaker performance compared to the previous year. Indonesia still accounted for 58% of the total funding in Southeast Asia, with raises like the $20M by Chickin to grow its digital solution for poultry farmers, and it was the third-highest funded country across all African and Emerging APAC countries.

But several key players in the country went through multiple rounds of layoffs or even ceased operations reflecting challenging market conditions. eFishery itself, Indonesia's first agritech unicorn and the only aquatech unicorn globally, suspended its co-founders amid amidst an ongoing investigation into alleged financial irregularities.

On a positive note, the rest of Southeast Asia did well, registering a 58% y-o- increase in 2024, with markets like Vietnam and Thailand seeing more activity, while players based out of the regional tech hub of Singapore, like Rize and AgriG8, secured funding for their multi-country play.

Terminations and DPIs in the horizon

It is undeniable that 2024 also brought to digital agriculture practitioners a sense of realism when it comes to the commercial viability and scalability of private-sector lead agritech initiatives. In the year we saw several startups “going down” and some notable organisations ceasing operations. This was the case of Kenya’s iProcure, which in May entered administration as it faced bankruptcy, of India’s Greenikk, a digital platform for banana farmers, and of US-based Gro Intelligence, a well-established player working across LMICs. Founded in 2012, the company had raised USD 85 million in a Series B round in 2021.

Building on recent developments, 2024 marked a turning point for the growing prominence of sector-specific Digital Public Infrastructure (DPI). Amid the challenges faced by many private-sector providers of agritech solutions and declining funding in the sector, there is a rising call for greater public sector leadership and involvement in digital agriculture. DPIs are digital platforms and systems designed to enable equitable access to public and private services, data, and technologies.

The promise of DPIs lies in their potential to address the persistent issues of fragmented and unverified datasets, creating a standardised and accessible repository of data for anyone looking to innovate. By democratising access to critical information, DPIs have the capacity to stimulate innovation across all levels of the agriculture ecosystem.

It is important to recognise that DPIs and private-sector innovation are not mutually exclusive. In fact, as DPIs gain traction, they have the potential to become a transformative force for all actors involved in digital agriculture. A notable example is India, where the government invested $336 million in its 'Digital Agriculture Mission' in 2024. This initiative positions India as a key player to watch in 2025.

Looking ahead, I anticipate a strong recovery in agritech funding this year, particularly in India, where startups are expected to benefit from an increasingly supportive and enabling environment.